Enhancing Digital Security with Facial Verification and NFC Verification

In today’s fast-paced digital world, businesses and users demand secure, seamless, and fast identity verification solutions. Among the most advanced technologies leading this transformation are Facial Verification and NFC Verification. Together, they create a powerful combination that ensures authenticity, reduces fraud, and enhances user experience in digital onboarding and KYC verification processes.

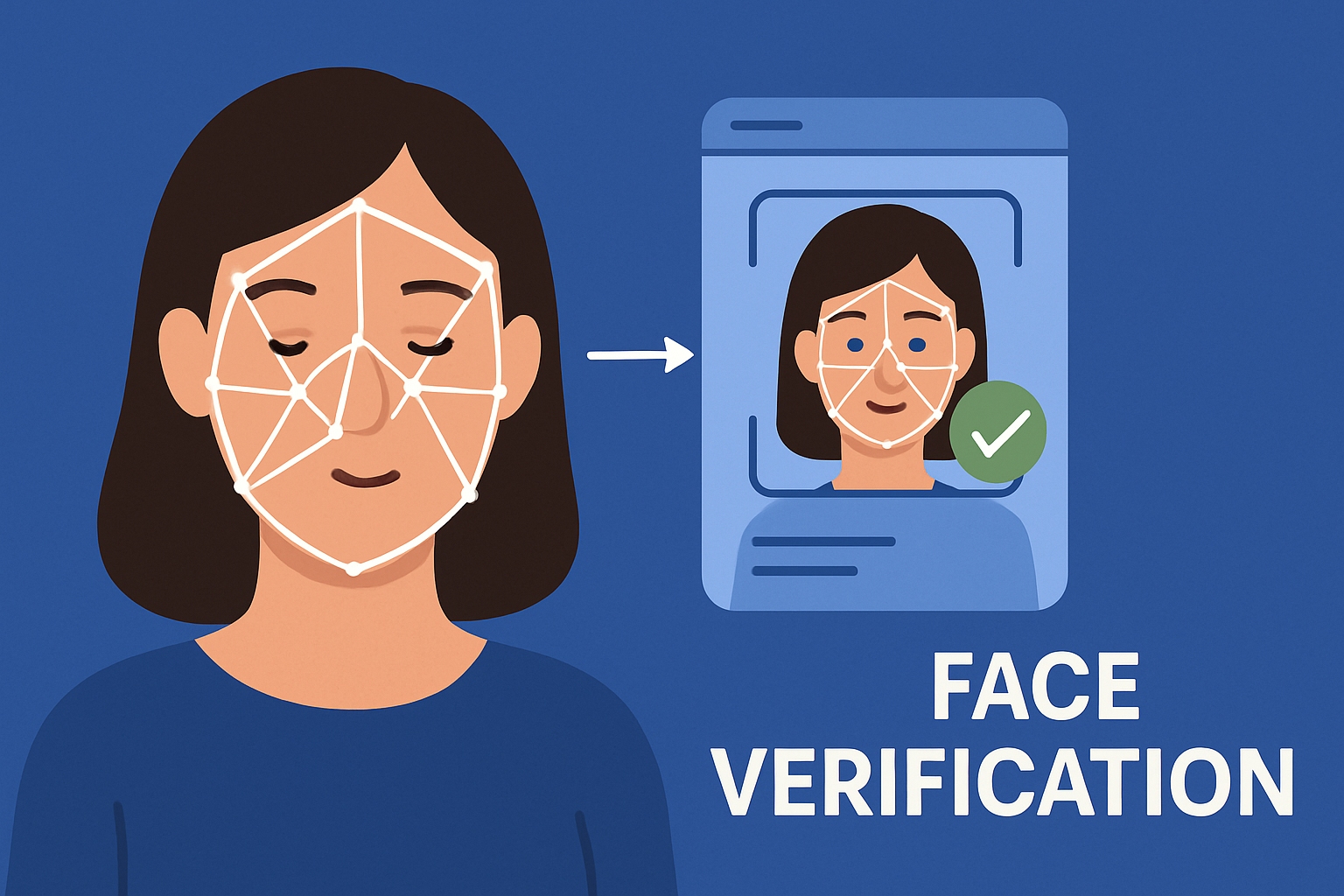

What is Facial Verification?

Facial verification is a biometric authentication process that uses artificial intelligence (AI) to identify and verify an individual’s face. It captures facial features such as the distance between the eyes, shape of the jawline, and unique facial patterns to compare them with stored images. This technology ensures that the person attempting verification is genuine and physically present, reducing risks of impersonation or spoofing.

Modern facial verification systems also include liveness detection to differentiate between a live person and a static image or video replay. This makes it a reliable solution for sectors like banking, fintech, healthcare, and government services where digital identity verification is essential.

Understanding NFC Verification

NFC (Near Field Communication) Verification allows smartphones to read biometric and personal data directly from an NFC-enabled identity document, such as an e-Passport or National ID card. This method ensures that data is read directly from the secure chip embedded in the document, minimizing risks of data tampering or forgery.

With NFC verification, users can simply tap their ID on a compatible device, and the system retrieves and verifies the chip’s data — including the holder’s name, photo, and biometric details. This not only speeds up the KYC process but also enhances security by verifying the authenticity of the document itself.

Benefits of Combining Facial and NFC Verification

When facial verification is paired with NFC verification, it offers unmatched accuracy and convenience. The system first reads the identity document via NFC, and then facial verification confirms that the person presenting the document matches the photo on the chip.

Key benefits include:

-

Faster Onboarding: Quick identity verification within seconds.

-

High Security: Eliminates fake identities and document fraud.

-

User Convenience: Seamless, contactless, and mobile-friendly process.

-

Global Compliance: Meets KYC and AML regulations worldwide.

Conclusion

The integration of Facial Verification and NFC Verification is revolutionizing digital identity verification. These technologies provide a frictionless, secure, and efficient way to authenticate users while preventing fraud. As more organizations embrace digital transformation, adopting these advanced verification methods will be essential for building trust, compliance, and a safer digital future.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spiele

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness