Piercing Pattern Candlestick Explained | Learn Stock Market Basics

Piercing Pattern Candlestick: A Simple Guide to Spot Market Reversals

Ever heard of the phrase, “The calm before the storm”? In the world of trading, that calm often appears as a pattern on your charts—a piercing pattern candlestick—hinting that the storm of reversal might be near. Let’s decode this fascinating candlestick pattern in simple terms.

Imagine you’re driving down a slope (a falling market), and suddenly your car slows and starts climbing again. That turning point is what the piercing line pattern represents—a potential upward shift after a downward trend.

Discover what a piercing pattern candlestick is, how the piercing line pattern works, and find the best stock market course to master candlestick trading.

What Is a Piercing Pattern Candlestick?

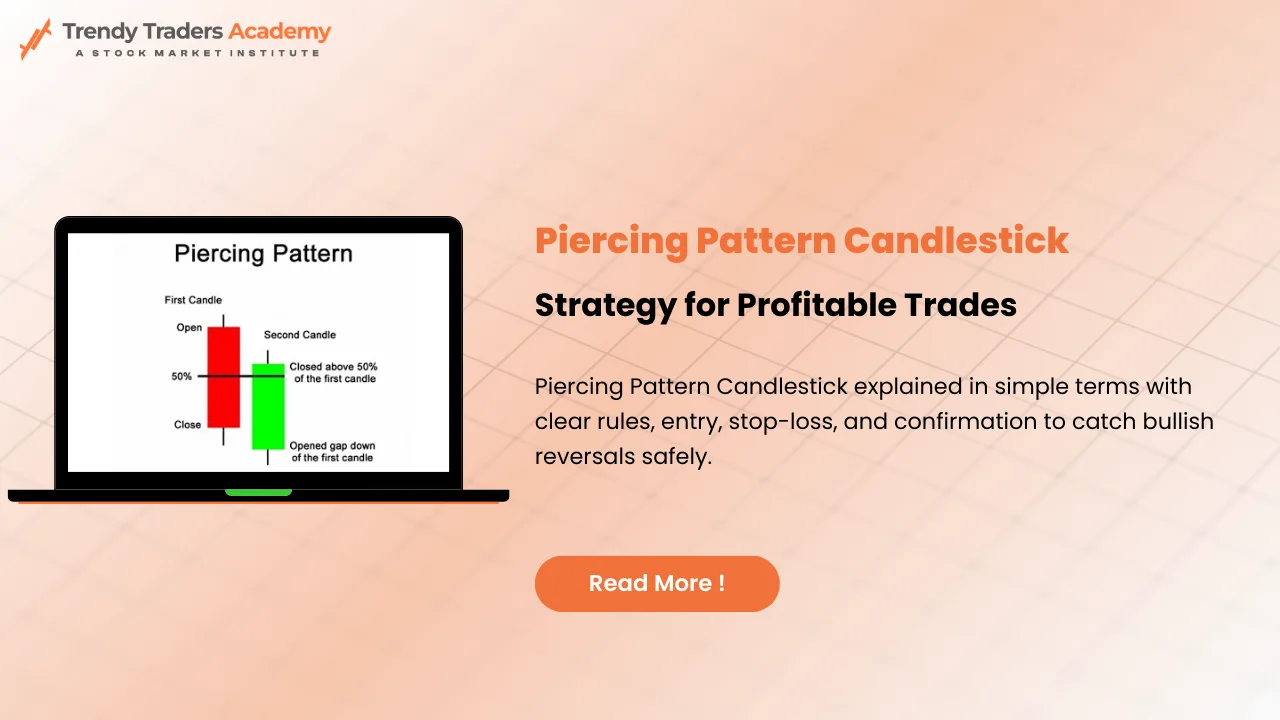

A piercing pattern candlestick is a bullish reversal pattern that often appears at the end of a downtrend. It’s made up of two candles:

-

The first is a long bearish candle (red or black).

-

The second is a bullish candle (green or white) that opens lower but closes above the midpoint of the first candle.

This means buyers are stepping in and overpowering sellers—hinting that prices might soon move up.

Why Traders Love This Pattern

Traders adore the piercing line pattern because it often appears right before a price recovery. It’s like spotting a green traffic light after sitting at a red one for too long—the signal to go long (buy).

Some benefits include:

-

Easy to identify on charts.

-

Works well with other indicators.

-

Offers early entry signals in bull reversals.

However, no single candlestick guarantees success, and this one is no exception.

Understanding the Structure of a Piercing Line Pattern

Let’s visualize it: imagine two candles standing side by side.

-

The first is red, showing that sellers dominated.

-

The second opens lower (showing panic), but then climbs and closes above the red candle’s midpoint.

That “piercing” through the previous day’s body gives the pattern its name—the piercing line pattern.

In short:

-

Candle 1: Bearish (closing lower).

-

Candle 2: Bullish (closing above Candle 1’s midpoint).

This shift indicates bulls regaining strength.

The Psychology Behind the Piercing Pattern

Every candlestick tells a story of trader emotions. The piercing pattern candlestick tells a powerful one: panic followed by confidence.

Here’s what’s happening psychologically:

-

Day 1: Sellers dominate, pushing prices down.

-

Day 2 Morning: More selling pressure as the new candle opens lower.

-

Day 2 Afternoon: Buyers fight back, closing above the previous mid-level.

This comeback signals growing bullish confidence—a cue for potential trend reversal.

Conditions for a Valid Piercing Pattern

To ensure your analysis is accurate, confirm these conditions before trusting the signal:

-

Appears after a downtrend.

-

The bullish candle’s opening is below the prior close.

-

The bullish candle’s closing is above the midpoint of the previous candle.

-

Higher trading volumes strengthen the pattern's validity.

Checking all four helps reduce false signals.

The Difference Between the Piercing Pattern and Bullish Engulfing Pattern

They look similar but have a critical difference.

-

In a bullish engulfing pattern, the second candle completely engulfs the first one.

-

In a piercing pattern candlestick, the second candle only pierces above the midpoint of the first.

Both are bullish, but the engulfing is stronger. Think of it like two boxers: in one fight, the bull just lands a solid punch (piercing pattern), whereas in the other, it fully dominates (engulfing).

How to Identify a Piercing Pattern on Charts

Spotting it is quite straightforward:

-

Look for a downtrend.

-

Wait for two candles: a red followed by green.

-

Check if the green candle opens below the red’s close but closes above its midpoint.

-

Confirm using other analyses (like RSI or volume).

Once spotted, treat it as a bullish signal, but always verify before trading.

How to Trade Using the Piercing Line Pattern

Trading the piercing line pattern can be rewarding when done cautiously. Here’s a common approach:

-

Confirm the trend: Ensure the market was in a clear downtrend.

-

Wait for the pattern: Identify the 2-candle formation.

-

Check indicators: RSI below 30 or MACD crossover strengthens the signal.

-

Enter: Buy when the price moves above the second candle’s high.

-

Set stop-loss: Just below the low of the second candle.

-

Take profit: Use nearby resistance or Fibonacci levels.

This disciplined method minimizes risk while maximizing potential returns.

Common Mistakes to Avoid

New traders often misread the piercing line pattern because they hurry to enter trades. Avoid these pitfalls:

-

Trading without confirming a downtrend.

-

Ignoring volume and momentum indicators.

-

Entering before the candle completes.

-

Skipping stop-loss setup.

Even a strong candlestick signal can fail without proper confirmation.

Combining Piercing Patterns with Technical Indicators

To increase accuracy, combine candlestick signals with technical tools like:

-

RSI (Relative Strength Index): Detects oversold conditions.

-

MACD: Shows bullish crossovers.

-

Moving Averages: Helps confirm trend changes.

-

Volume Analysis: Confirms buyer strength.

These combinations form a more reliable trading setup.

Real Market Examples of Piercing Line Patterns

Let’s take a real-world scenario: imagine Tata Motors stock dropping for several days. Then you notice a piercing pattern—one large red candle followed by a strong green one closing above the midpoint.

A few sessions later, the stock starts climbing. This pattern shows how quickly sentiment can shift when buyers regain confidence.

Timeframes Where It Works Best

While the piercing pattern candlestick works on any timeframe, it’s most reliable on:

-

Daily charts for stock investors.

-

4-hour or 1-hour charts for swing traders.

-

15-minute charts for intraday setups.

Lower timeframes may produce noise, so focus on larger intervals for accuracy.

Piercing Pattern in Forex and Crypto

Interestingly, the piercing line pattern works across all asset classes—not just stocks.

-

In forex, it often signals reversal after intense selling.

-

In crypto, it’s visible during corrections before recovery.

However, since these markets are highly volatile, always pair patterns with trend confirmation tools.

Mastering Candlesticks Through the Best Stock Market Course

If reading candlesticks feels confusing, enrolling in the best stock market course can simplify the process. These courses often teach:

-

Chart reading skills.

-

Candlestick psychology.

-

Technical indicators and risk management.

-

Live trading examples.

Learning through experts helps turn theory into practice. Look for courses offering mentorship, webinars, and backtesting sessions.

Investing in education, rather than guessing, turns hopeful trading into informed decision-making.

Conclusion

The piercing pattern candlestick may look simple, but it carries deep insight into market psychology. It shows how buyers can regain control after a bearish phase, acting as an early bullish signal.

Still, remember—context matters. Always confirm with volume, trendlines, and other indicators before acting. Combine this learning with insights from the best stock market course, and you’ll soon spot reversal patterns like a pro.

FAQs

1. What does a piercing pattern candlestick indicate?

It indicates a bullish reversal—where buyers start to overpower sellers after a downtrend.

2. How reliable is the piercing line pattern?

It’s fairly reliable but works best when confirmed with indicators like RSI or MACD.

3. Is the piercing pattern and bullish engulfing the same?

No. In the engulfing pattern, the second candle fully covers the first, while in the piercing pattern, it closes above the midpoint.

4. Can I use the piercing pattern for intraday trading?

Yes, but use it on 15-minute or higher charts and confirm with volume and support levels.

5. Where can I learn more about candlestick trading?

You can join the best stock market course that focuses on technical analysis and real-time chart training.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Игры

- Gardening

- Health

- Главная

- Literature

- Music

- Networking

- Другое

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness