Mobile Home Insurance Requirements

Failure to have the right insurance will leave you with huge losses. In this process, I’ll show you step-by-step what insurance you’ll need for a mobile home and when you’ll need it, what a good policy will cover (or not cover), and how to choose the right plan that will protect you.

Reliable residential estimating helps determine the actual cost of rebuilding a home by preparing detailed material takeoffs and accurate cost estimates before an insurance policy is purchased. Completing this groundwork in advance ensures that the selected coverage reflects real construction expenses rather than assumptions. As a result, homeowners gain a clear understanding of what to evaluate and how to choose coverage that truly protects their property.

What Is Mobile Home Insurance?

A mobile or manufactured home (also known simply as a mobile home) cannot be insured in the same way as a regular home. This is because mobile homes have different risks and structural features.

A mobile home policy (also known as an HO-7 or “tailored home insurance plan”) is designed to cover these homes. This is a policy that covers the structure of the home, personal property, and liability, similar to regular homeowners' insurance, with a few differences based on the unique sensitivities of mobile homes.

Mobile homes are constructed differently than regular homes because the construction is typically lighter, more exposed to wind and weather, which is why insurance companies treat them differently.

Is Mobile Home Insurance Legal or Not?

Here’s the truth: The answer is, in most cases, no, federal or state law does not mandate mobile home insurance.

However, not to mention that you have a mortgage or loan to finance your home, many times it can and will be required. Before making a loan or releasing money, lenders almost always insist on showing that the loan is insured. Additionally, in the case of renting a lot in a manufactured home community (mobile home park), the laws of that community or the park owner may insist that you have a liability policy.

Thus, while it may not be legally required, insurance is usually a de facto necessity even if you want to protect your investment, or you may have to borrow money to buy a home.

In short:

-

Legal requirement? Usually no.

-

Useful, practical, and financial requirements? Very often, yes.

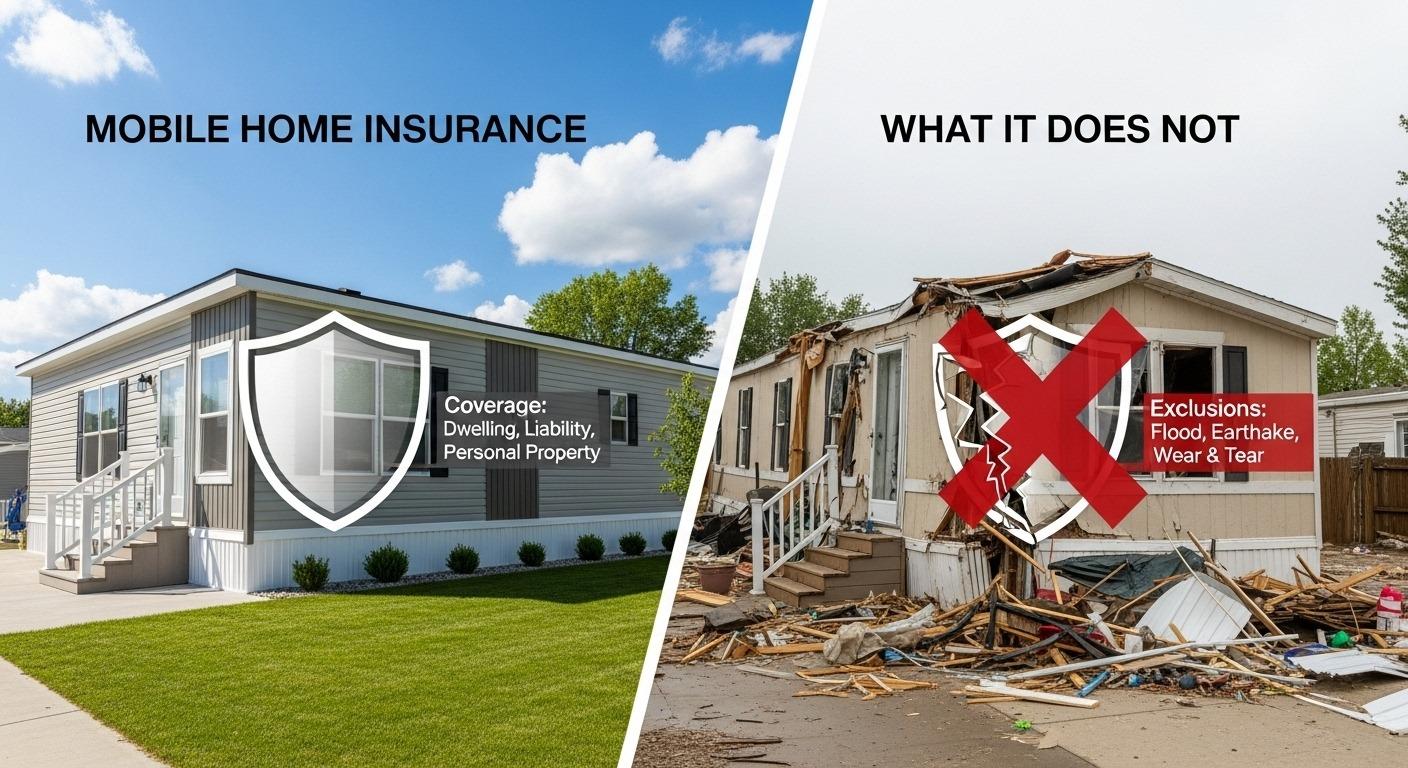

What Does Mobile Home Insurance Entail: And What It Does Not

The policy that you normally get when you obtain a good mobile home insurance policy contains:

Common Coverage Items

-

Dwelling coverage: that covers walls, exterior structures, built-in systems, plumbing, and other essential components. When a covered peril damages your home, the policy pays for the cost of repair or rebuilding based on accurate assessments prepared by a roofing estimating company, ensuring material takeoffs and repair costs are calculated correctly.

-

Personal property cover: this covers the property in your house: furniture, electronics, clothing, and appliances, among others.

-

Other structures coverage: It covers detached or separate structures on your premises (sheds, detached garages, carports, etc.).

-

Liability coverage: In case a person is injured within your premises or you accidentally destroy the property of another individual, liability coverage will save you some money.

-

Loss-of-use / Additional living expenses coverage: in case one of the covered perils renders your home uninsurable, this may assist in covering temporary living expenses (hotel, food, etc.).

What It Does Not Normally Include: Unless You Include It

Typical mobile-home insurance does not cover the following:

-

Take flood damage: a flood damage policy is usually required when in a flood-prone region.

-

Damage due to earthquakes or sinkholes: in high risk regions, you might be required to purchase an endorsement or separate policy.

-

Damage due to normal wear, rust, decay,y or neglect: insurance does not cover normal wear, rust, decay, or neglect.

-

Damage caused by pests (termites, rodents, etc.): is generally regarded as a maintenance point, not covered.

-

Damage owing to a manufacturer's defect or improper installation: in most cases, defects are not covered except in the event of an accident.

What This Means

Certainly, even with a simple mobile-home insurance policy, you will encounter significant losses in the event of a flood, earthquake, or wear and tear over time. You will need to think about additional coverage or endorsements in case you are in a prime location where you need them. It is prudent to negotiate with an insurance agent and see what is covered under it- do not consider that all is covered.

What are the influences on your Insurance needs and Premium

Mobile-home insurance is not always equally expensive

Here is what the insurers consider when deciding whether to make it mandatory (or not), or not and how much to charge:

-

With or without a mortgage: A mortgage holder will nearly always be required to take insurance.

-

Location and local risks: Houses located in a prone area like hurricanes, strong winds, floods, tornadoes, etc, are usually more expensive to insure.

-

The age and condition of the mobile home: Mobile homes that are old or in poor condition may be more difficult (or costly) to insure.

-

Construction information of the house: Foundations (permanent or wheels), tie-downs or anchoring, structural safety, and upgrades can be important.

-

Coverage amount and optional coverage: Reduced deductibles, all-inclusive coverage or additional endorsements (flood, wind, replacement value) increase premiums.

-

Security and safety characteristics: Smoke detectors, security systems, roof tie-downs, or storm-resistant additions can be used to reduce expenses.

What to do to ensure that your mobile home is insurable

In case you want to buy good mobile-home insurance (or renew it), the following are some of the useful activities that can be performed; take this as a checklist.

Requirements on Check Foundation

In case your home is on wheels or it is built on a chassis (as is the case with mobile homes) most of the insurers will insist on proper tie-downs.

In case it has been converted to a permanent foundation, ensure that it is recognized by the insurer as such; some companies still consider it as a mobile structure.

Assure structural integrity and upkeep

Maintain the roof, electrical systems, and heating systems in good condition, and rely on interior plumbing estimating services to assess material quantities and repair costs accurately. Stricter underwriting is usually applied to older homes, making proper evaluation and planning even more important.

You can have safety measures installed, such as smoke warnings, windproof, or windstorm tie-downs, in case you live in a prone area of weather. This is able to reduce the premiums or make insurers more eager to pay you.

Get the correct covering, and request endorsements, where necessary

-

Get the proper base cover: dwelling, personal property, liability, other structures and loss of use.

-

In flood or earthquake-prone areas, you can have flood or earthquake insurance on its own.

Have proper rebuild cost valuation

Have a good estimator, say, through estimating services, to be aware of the cost that would be incurred to rebuild or replace your home. This assists in establishing reasonable coverage.

Ensure that coverage is equal to replacement cost and no longer actual cash valu,e as then you are guaranteed in case of disaster.

Compare policies and the insurers

Other insurers reject the old or risky mobile homes or provide less cover.

Never forget to check what is not included, particularly in the case of floods, earthquakes, wear and tear, and any other problems involved in maintenance.

Real Case Study: Why a Buttressed Policy is Important

Suppose you own a manufactured home in a location that is routinely hit by severe storms. You don’t carry insurance because nothing can go wrong. Then a strong wind blows in. The roof is destroyed, the siding is torn off, and the windows are shattered. Without insurance, you’re left with huge repair costs, thousands of dollars out of pocket.

However, with an HO-7 policy that covers the dwelling and loss of use, the insurance company will cover the repairs. And if the home is unlivable, the loss of use can help pay for hotel and living expenses while you rebuild.

Or maybe you own a home but are renting a lot in a mobile home park, but don’t have a mortgage. Some guest slips and fall on your walkway and sue you. Without liability coverage, you’re left with legal fees and damages. With insurance, you’re covered for everything you own.

This is why, even though insurance is not something that is enforced by law, it is usually the smartest step you will take.

Next to Take: How to Get a Good Mobile Home Insurance

-

Check the foundation, the structure, and the history of the maintenance of your home.

-

Estimate the replacement-cost (look at [usa estimating services]) to have an idea of what to be covered.

-

Get in touch with various mobile homes insurers, enquire about what is covered, what is not covered, and what is optional (flood, wind, earthquake etc).

-

Examine policy documents. Do not simply take the word of price coverage limits, exclusions and any endorsements.

-

Think of upgrades (tie-downs, security system, storm-proofing) to minimize risk and potentially pay less.

Conclusion

Here’s the bottom line: Mobile home insurance isn’t always mandatory, as required by law, but it’s only a matter of time before people avoid it and end up in trouble. A proper policy covers you in the event of any disaster, theft, liability, and unexpected expenses. It keeps your home and all your hard work safe.

Now is the time to get a good policy with the right coverage. Do your research, get the right estimate, and your mobile home is a treasure, and treat it like one. You’ll be grateful in the future.

Plan to ensure it in advance? The first thing to do is to evaluate the cost of replacing your home, compare prices, and choose a policy that meets your needs and risks. Protecting your home today is a good idea for peace of mind tomorrow.

FAQs

Do I need insurance when I own my mobile home (have no loan) completely?

There will not be many jurisdictions in the country where you are not legally obliged to be covered by insurance in case you fully own the house. There are, however, a lot of mobile-home communities or parks which might need liability coverage in case you rent land.

Is a regular homeowners' insurance policy a cover for mobile homes?

Usually not. The risk profile and construction of mobile homes often places them out of the range of normal homeowners' insurance. That is the reason why the insurers provide specialized policies (such as HO-7) to manufactured houses.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Spellen

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness